sales tax reno nv 2019

For every low-speed vehicle as that term is defined in NRS 484527 a fee for registration of 33. Please consult your local tax authority for specific details.

Some dealerships may also charge a 149 dollar documentary fee.

. Nevada sales tax details The Nevada NV state sales tax rate is currently 46. Nevada collects a 81 state sales tax rate on the purchase of all vehicles. This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable.

How 2021 sales taxes are calculated in nevada. Fast Easy Tax Solutions. Sales tax rate in Washoe County including Reno and Sparks is 8265 effective April 1 2017.

Click any locality for a full breakdown of local property taxes or visit our Nevada sales tax calculator to lookup local rates by zip code. Please consult your local tax authority for specific details. You can print a 8265 sales tax table here.

Less than 6000 pounds a fee of 33. With local taxes the total sales tax rate is between 6850 and 8375. The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794.

Average Sales Tax With Local. Historical Sales Tax Rates for Reno 2022 2021 2020 2019 2018 2017 2016. In the 2011 Legislative Session reduced the interest rate to 075 or 0075 from 1 or 01 effective 712011.

Reno is in the following zip codes. Depending on local municipalities the total tax rate can be as high as 8265. For more information visit our ongoing coverage of the virus and its impact on sales tax compliance.

The reno sales tax rate is. College Parkway Suite 115 Carson City NV 89706. There are approximately 62730 people living in the Sparks area.

There is no applicable city tax or special tax. Groceries and prescription drugs are exempt from the Nevada sales tax. Download our Nevada sales tax database.

Nevada income tax rate and tax brackets shown in the table below are based on income earned between January reno nevada sales tax rate 2019 1 2020 through December 31 2020. If you need access to a database of all Nevada local sales tax rates visit the sales tax data page. This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable.

The current total local sales tax. Nevada Income Tax Rate 2020 - 2021 Oct 11 2018 Nevada state income tax rate for 2020 is 0 because Nevada does not collect a personal income tax. Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Texas.

For tax rates in other cities see Nevada sales taxes by city and county. Reno countys 2021 total did best in 2019 but was less than november 2016 which set the countys record for november prior to. Select the Nevada city from the list of popular cities below to see its current sales tax rate.

The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Reno. The other counties are as follows. College Parkway Suite 115 Carson City NV 89706 High reno nevada sales tax rate 2019 desert mountain city and college town University of Nevada Reno of.

For more information visit our ongoing coverage of the virus and its impact on sales tax compliance. FY 2019 Nevada Federal Per Diem Rates. For every motor truck truck-tractor or bus which has a declared gross weight of.

Not less than 6000 pounds and not more than 8499 pounds a fee of 38. Not less than 8500 pounds and not more than 10000. Boost your business with wix.

Reno NV 89520-0027 Information. Reno NV 89520-0027 Information. 89501 89502 89503.

Ad Find Out Sales Tax Rates For Free. Of Taxation 1550 E. Nevada has a 46 statewide sales tax rate but also has 34 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3357 on top of the state tax.

In addition to taxes car purchases in Nevada may be subject to other fees like registration title and plate fees. An alternative sales tax rate of 8265 applies in the tax region Reno which appertains to zip code 89431. Effective January 1 2020 the Clark County sales and use tax rate increased to 8375.

Counties and cities can charge an additional local sales tax of up to 125 for a maximum possible combined sales tax of 81. The correct tax rates will display based on the period end date selected. The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Reno.

If you have any questions please contact the Departments call center. Do I have to pay Nevada Sales Tax when I purchase a boat. Yes if the boat is purchased for use or storage in Nevada.

Total US government revenue for 2019 is 677 trillion including 346 trillion federal 188 trillion state and 143 trillion local. NAC 372055 NRS 372185. Other local-level tax rates in the state of Nevada are quite complex compared against local-level tax rates in other states.

89432 89434 89435 89436 and 89441. Sales Tax Breakdown Reno Details Reno NV is in Washoe County. There are a total of 34 local tax jurisdictions across the state collecting an average local tax of 3357.

This means that depending on your location within Nevada the total tax you pay can be significantly higher than the 46 state sales tax. The Sparks Nevada sales tax rate of 8265 applies to the following five zip codes. For use in White Pine county effective 712009 and Washoe county 712009 through 3312017.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Nevada. The December 2020 total local sales tax rate was also 8265. The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665 Washoe County sales tax.

Nevada State And Local Taxes. Effective January 1 2020 the Clark County sales and use tax rate will increase to 8375. Nevada has recent rate changes Sat Feb 01 2020.

Nevada has state sales tax of 46 and allows local governments to collect a local option sales tax of up to 355. Sales Tax legitimately paid to another state is applied as a credit towards Nevada Use Tax due. On September 3 2019 the Clark County Commission passed a sales tax increase tied to improving education.

If proof cannot be provided Use Tax must be paid to Nevada. Of Taxation 1550 E. Reno NV Sales Tax Rate Reno NV Sales Tax Rate The current total local sales tax rate in Reno NV is 8265.

31 rows The state sales tax rate in Nevada is 6850.

Used Honda Civic Hatchback For Sale In Reno Nv Cargurus

Used Chevrolet Silverado 1500 For Sale In Reno Nv Edmunds

Jeep Wagoneer For Sale Reno Nv Lithia Chrysler Jeep Of Reno

Nevada Sales And Use Tax Close Out Form Download Fillable Pdf Templateroller

All Volkswagen Dealers In Reno Nv 89501 Autotrader

Lexus For Sale In Carson City Nv Carson City Hyundai

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

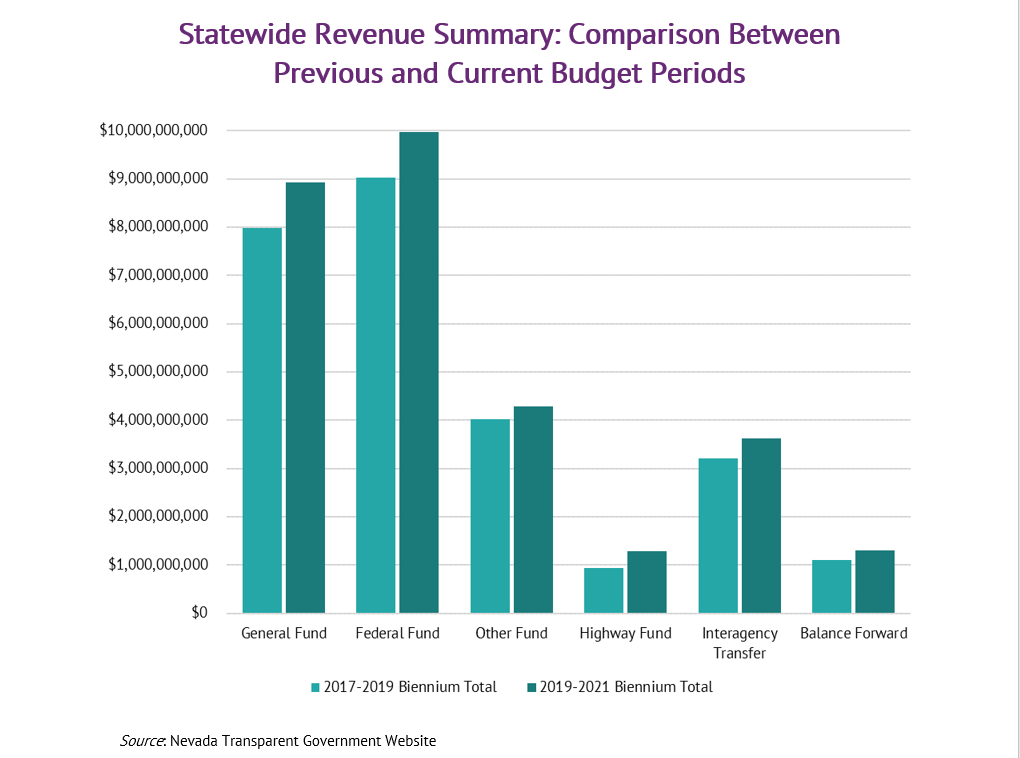

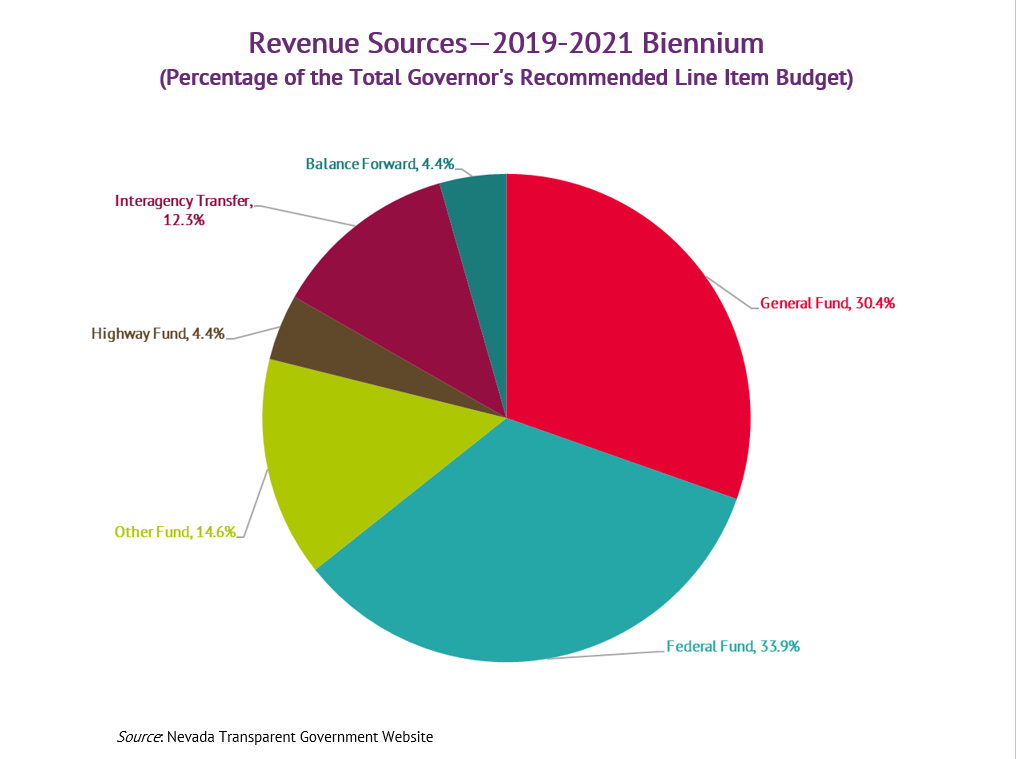

Nevada Budget Overview 2019 2021 Guinn Center For Policy Priorities

Nevada Budget Overview 2019 2021 Guinn Center For Policy Priorities

Used Gmc Canyon For Sale In Reno Nv Edmunds

Used Ford Flex For Sale In Reno Nv Cargurus

Used Chevrolet Traverse For Sale In Reno Nv Edmunds

Nevada Budget Overview 2019 2021 Guinn Center For Policy Priorities

Nevada Sales Tax Rates By City County 2022

Used Subaru Legacy For Sale In Reno Nv Cargurus

Used Toyota Rav4 In Reno Nv For Sale

Is Now Any Time To Raise The Property Tax Nevada Current