tax reduction strategies for high income earners australia

User 552406 11075 posts. The federal income tax is designed to tax higher levels of income at higher tax rates.

Why 5 Million Is Barely Enough To Retire Early With A Family

This is the rate that will apply to each additional dollar that you earn until you earn so much that you graduate to the next bracket.

. Annual expenses 17000 rent. And given the extortionate rent rates here and median house price I think single income earners getting 80k would be a good. My net income is about 52500 taking out regular income tax.

A tax bracket refers to the highest marginal tax rate that you pay on any part of your taxable income.

Most Americans Consider Themselves Middle Class But Are They Rand

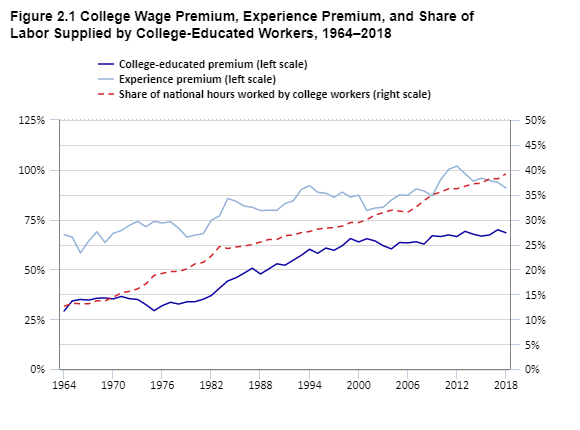

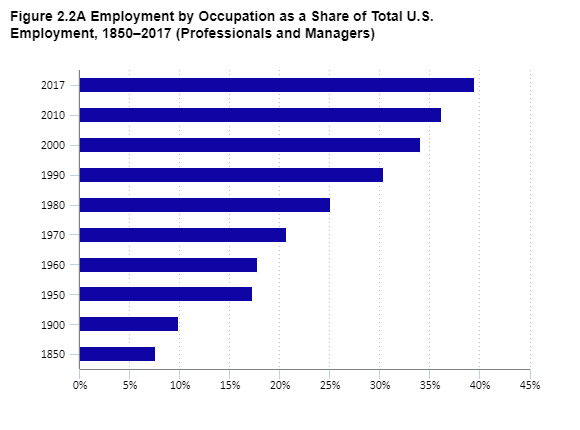

Assessing The Impact Of New Technologies On The Labor Market Key Constructs Gaps And Data Collection Strategies For The Bureau Of Labor Statistics U S Bureau Of Labor Statistics

Proposed Tax Changes For High Income Individuals Ey Us

How To Achieve Tax Compliance By The Wealthy A Review Of The Literature And Agenda For Policy Gangl 2020 Social Issues And Policy Review Wiley Online Library

Assessing The Impact Of New Technologies On The Labor Market Key Constructs Gaps And Data Collection Strategies For The Bureau Of Labor Statistics U S Bureau Of Labor Statistics

Fiscal Policy And Long Term Growth In Policy Papers Volume 2015 Issue 023 2015

Most Americans Consider Themselves Middle Class But Are They Rand

Why 5 Million Is Barely Enough To Retire Early With A Family

Most Americans Consider Themselves Middle Class But Are They Rand

Why 5 Million Is Barely Enough To Retire Early With A Family